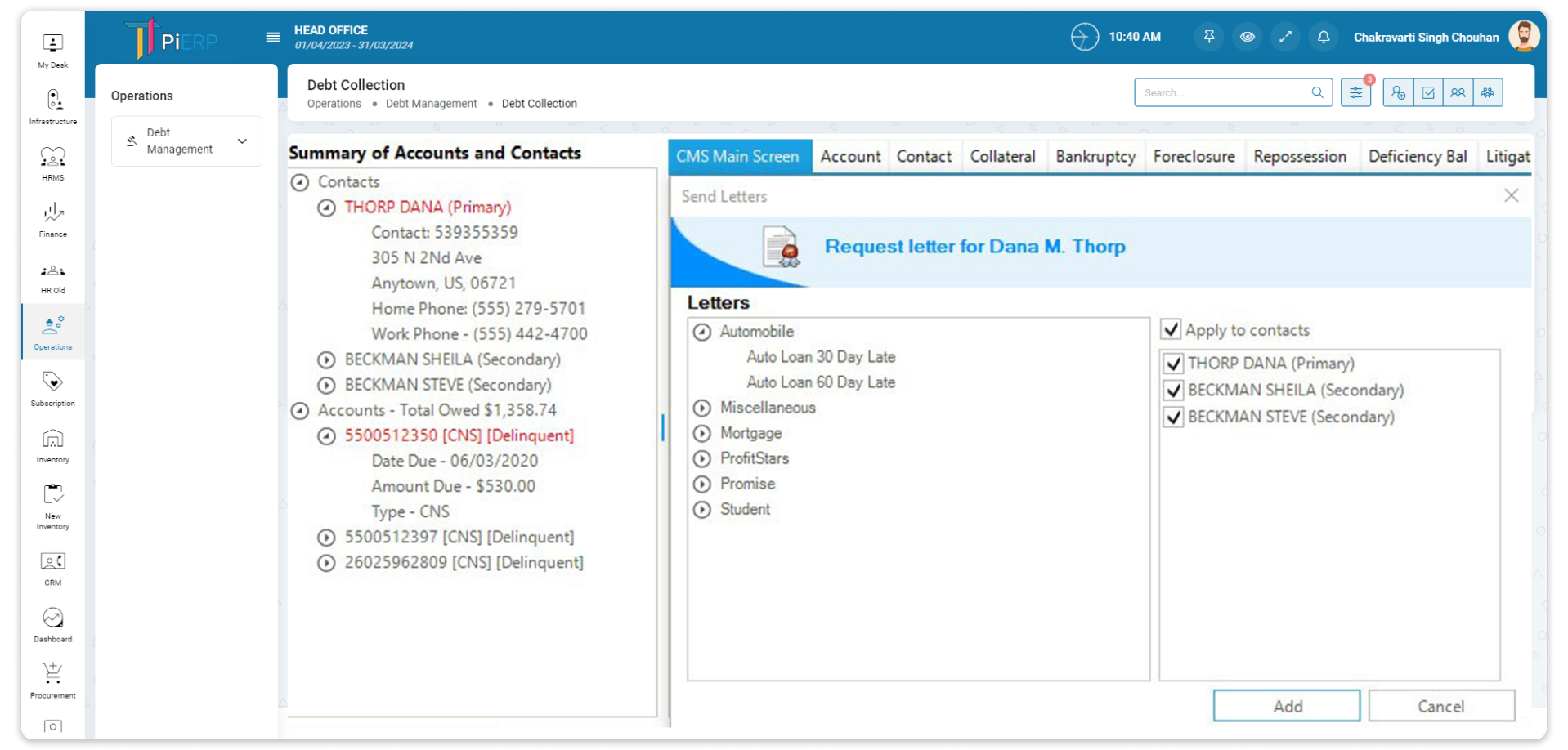

Streamlining Debt Recovery:

A Case Study on Implementing an Advanced Debt Collection Management System in a Financial Institution

Project Overview

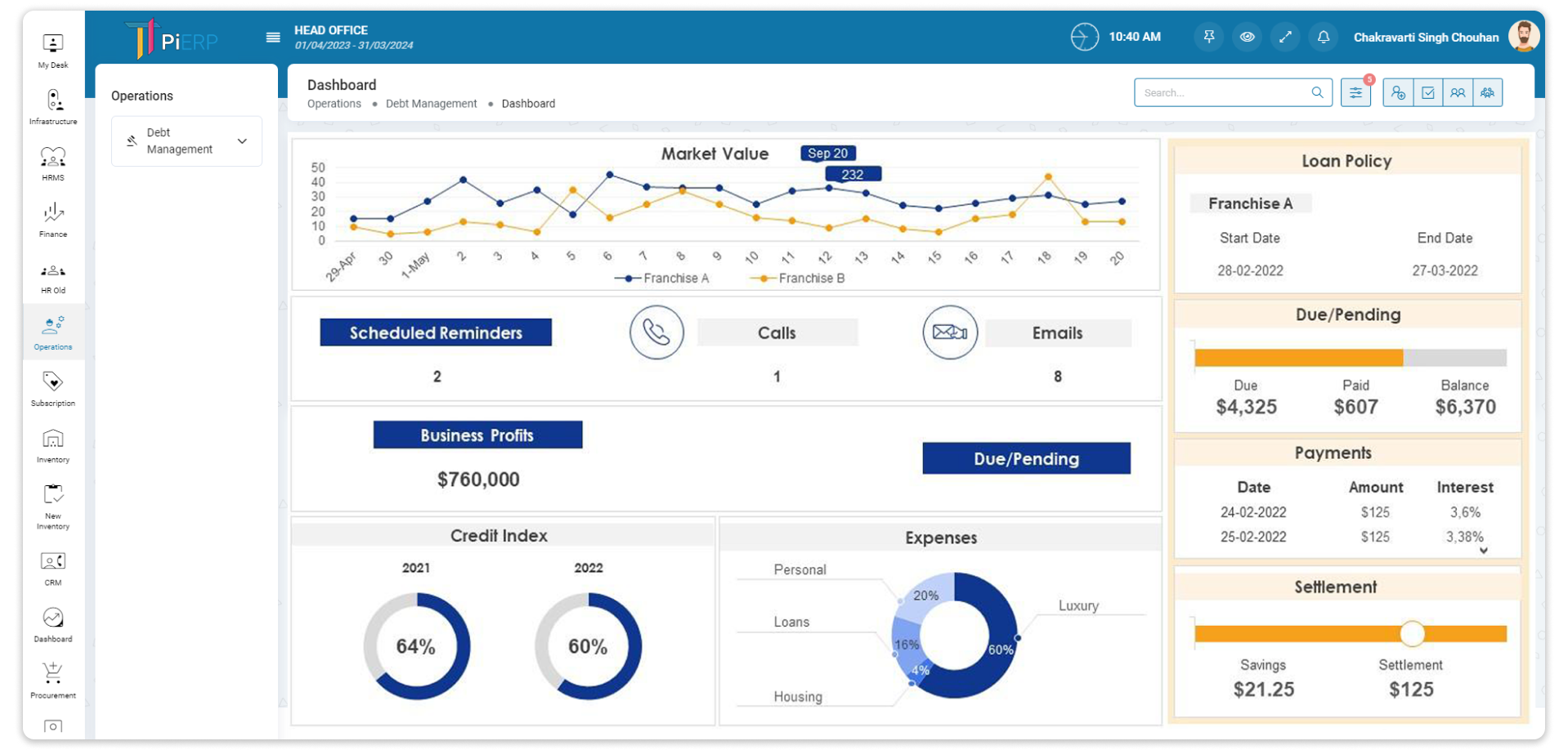

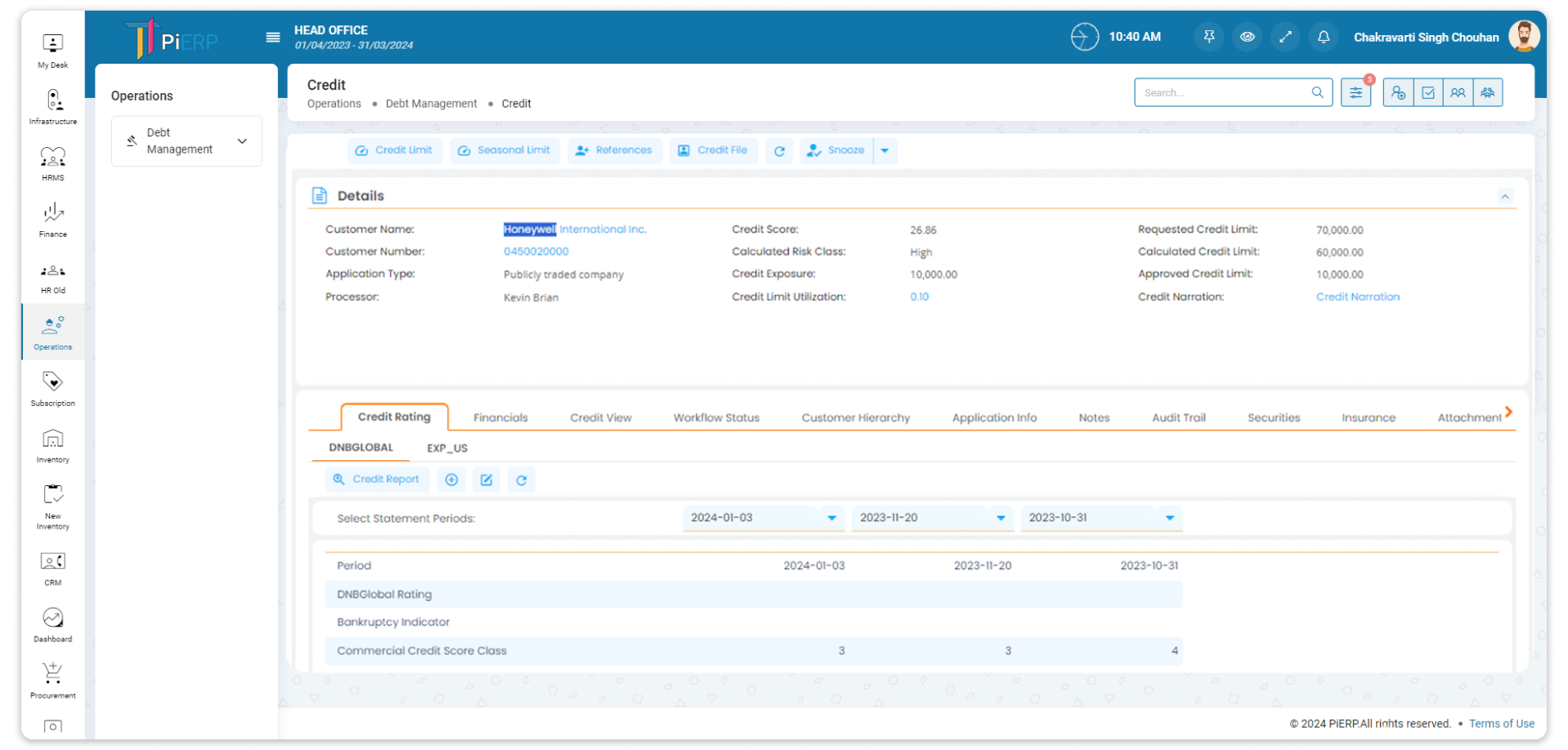

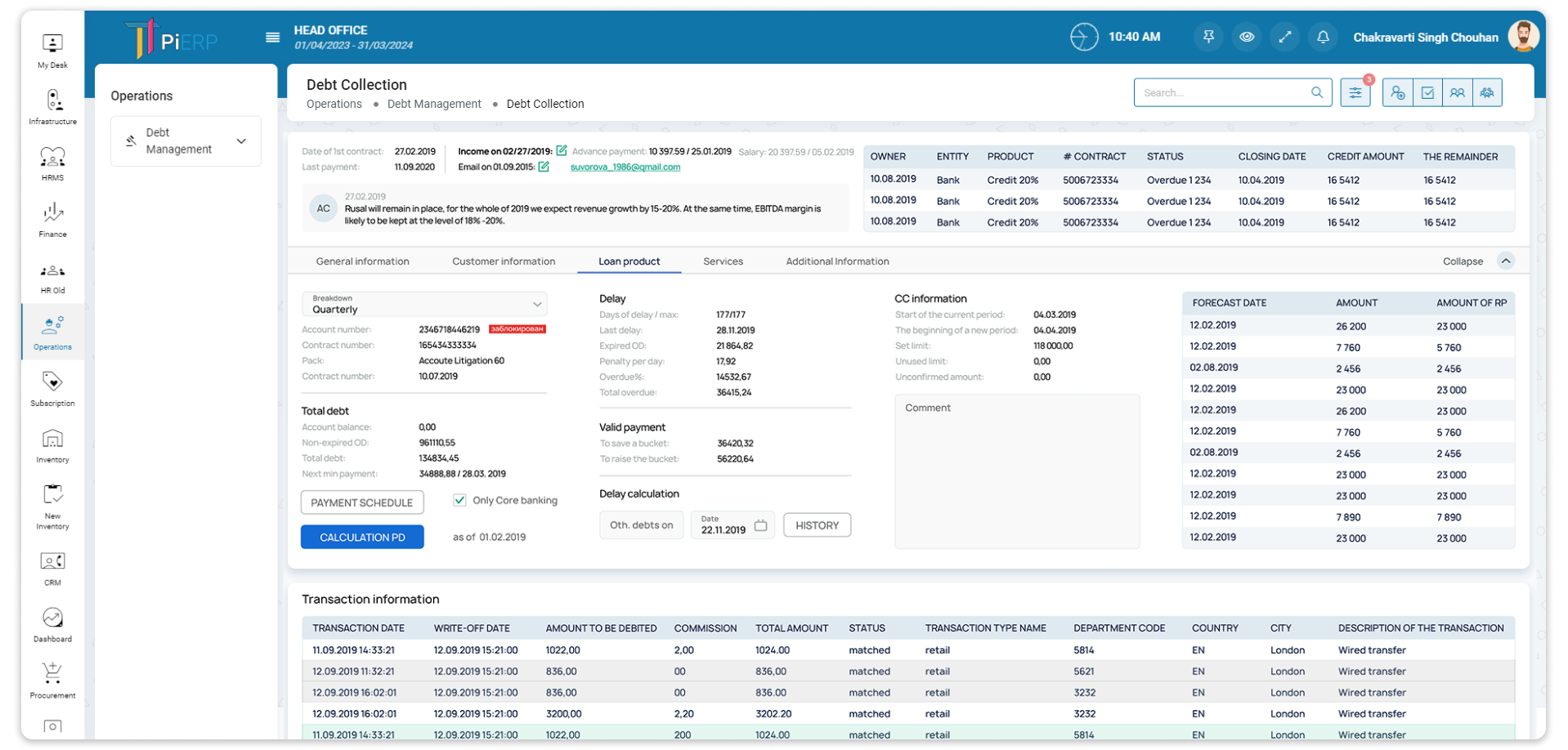

A Finance Service Company, based in Ahmedabad, India, offers a robust Collection and Debt Recovery Management System designed to meet the needs of financial institutions. This advanced tool effectively manages collection operations, streamlining the process to minimize write-offs and provisioning. It enhances cash flow and strengthens customer relationships, thereby enabling opportunities for future sales.

- Lending Services

- Finance

- Ahmedabad, Gujarat, India

- 1 Year