Revolutionizing Re-Finance:

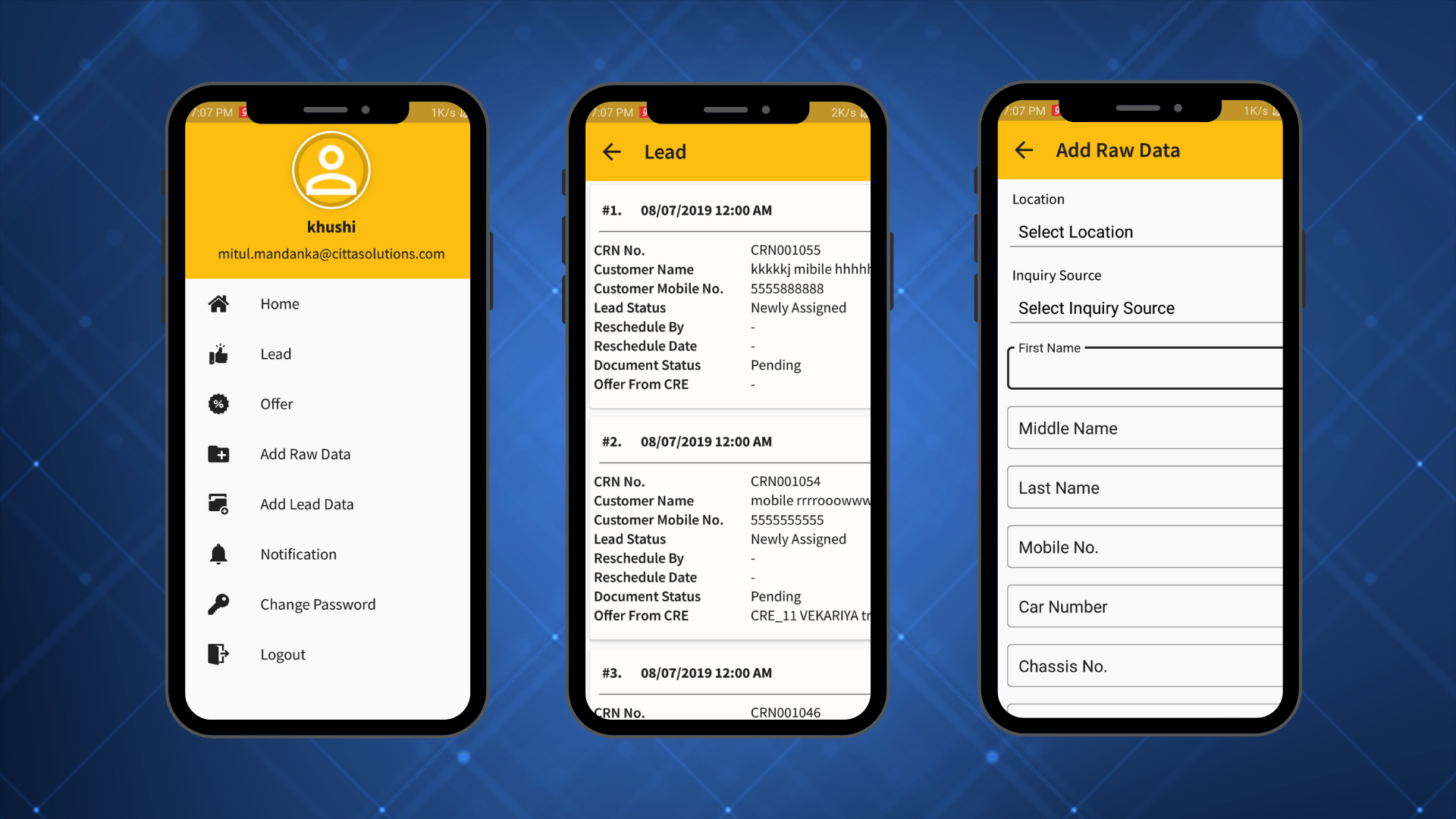

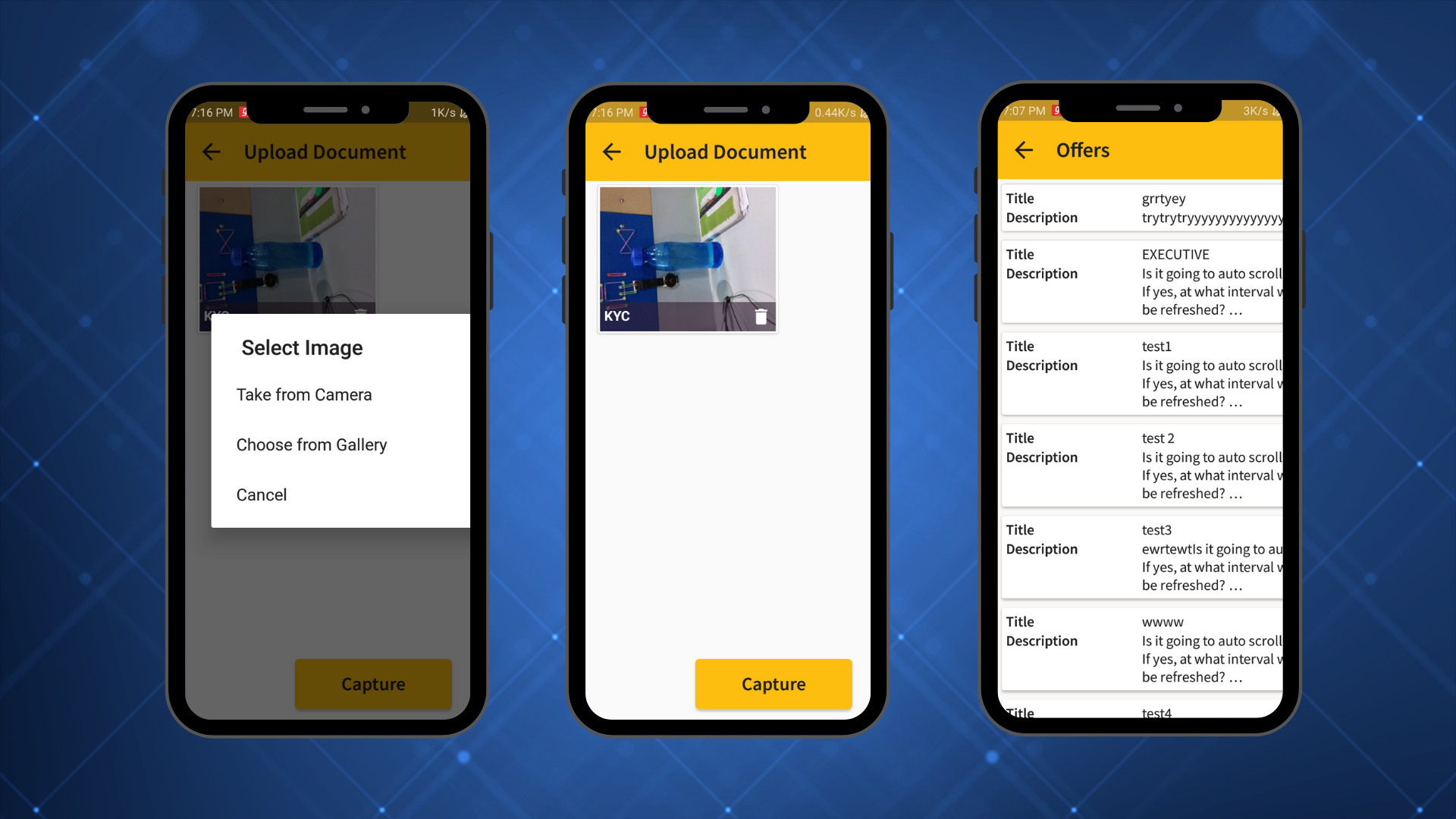

Enhancing Efficiency with Lending Management System and Mobile Application Integration

Project Overview

A Refinance Company, based in Ahmedabad, India, offers a comprehensive Lending Management System that automates every stage of the lending process, from data collection to fund disbursement. This system is tailored to meet the demand in the market for a streamlined and digitally enhanced lending experience.

- Refinancing

- Finance

- Mumbai, Maharastra, India

- 6 Months